The Benefits of 1099 Contractors Versus W2 Employeesįor apparent reasons, several business owners prefer the idea of contract work. Though, if you require a long-term employee that will be with you for the long haul, a W2 fits the bill perfectly. If this is the case, hiring a 1099 employee makes the most sense.

As a result, you won’t have long-term plans for this employee once the project is concluded. Long-Term Plans? Independent contract tasks frequently come and go with projects.If your employee will give an invoice to get paid and/or they will cover their own expenses, then a 1099 is your best choice. Do You Control How They Are Compensated? Do you plan on compensating your employee yourself, or are they paid by another person through reimbursement or other means? If you intend on paying your employee directly, a W2 makes sense.If not, a 1099 contractor will be the route you opt for. If authority over an employee’s calendar and overall workload is significant, you likely require a W2 employee. Hence, you have considerably more control over everything they do and “how ” they do it. This oftentimes suggests they come and go, and you won’t input in “ how ” they perform their job. Do You Examine How They Perform Their Job? A 1099 independent contractor is self-explanatory, they’re independent.The Internal Revenue Service has collected a list of 3 questions you should contemplate and answer before classifying a possible employee as a W2 or 1099 contractor. Additionally, W2 employees are oftentimes given specific benefits such as health care or vacation pay by your company.Īssistance Classifying Likely Employees From The IRS Some may even have a salary rather than an hourly income.

Whatever the agreement was, it will usually be routine and scheduled. W2: Ordinarily, a W2 employee will be compensated regularly, at a specific time each month, bi-weekly, or weekly.Your 1099 contractors are typically paid hourly and can be paid on a project basis as well. 1099: You can compensate your 1099 contractor on a modified schedule, also rotating on a project-to-project basis.Nevertheless, if your employee violates an agreement, you may terminate their employment. Of course, you still want to comply with state and federal labor laws. W2: With a conventional W2 employee, you are unconstrained to invoke at-will employment whenever you wish.In many circumstances, terminating such an employee will carry a 5-10 day notification of termination from both sides of the contract, indicating either on their end or yours. 1099: For example, with a 1099 employee, you must pay specific attention to the span of any contract that has been signed.This includes your capacity to fire or terminate the employee. You’re also liable for exercising Social Security tax, Medicare, and state and federal taxes out from your employee’s check.Īnother consequence separating the two sections of employment is what is called at-will employment. You must fill out and file with your state and government organizations, their unemployment insurance, worker’s comp, Medicare, and Social Security forms to name a few. W2: You, as an employer, absorb an abundance of the cost connected with your employees when you hire a W2-issued employee.That indicates they can claim unemployment on you. Be cognizant that if you contract work for 30 or more hours a week for over 90 days, the government will recognize that person as an employee. You will have to file the 1099 if your contractor earns over $600 annually from you, but the absolute size of what you are liable for is greatly reduced with a contractor in comparison to a W2 worker. This is why 1099’s are assigned to independent contractors. Additionally, you aren’t liable for unemployment, worker’s comp, or payroll taxes because you’re “ contracting ” work versus “hiring” an employee.

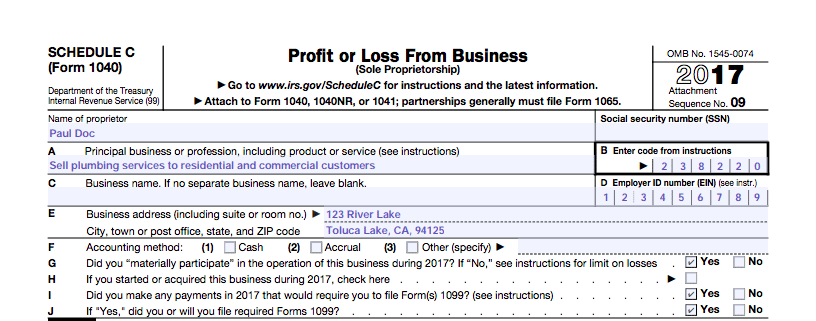

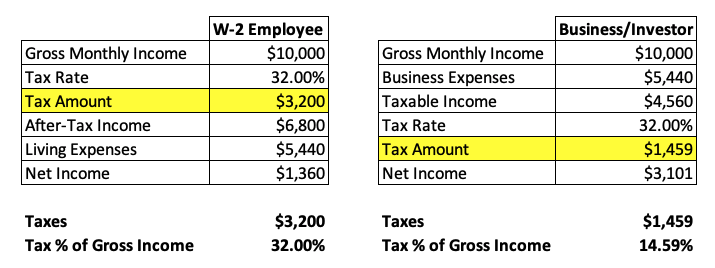

1099:, With a 1099 contractor, implying you issue them a 1099, you do not have to do payroll taxes.The following are 3 chief differences between W2 workers (standard employees), and 1099 independent contractors: Tax Differentiation Consequently, before determining if you would preferably hire1099 contractors or employ W2 assigned employees, here are some helpful distinctions between the two: Principal Differences Between 1099 Contractors and W2 Workers Especially when it comes to classifying your vendors, contractors, and employees-in regards to the type of employment. Whether you’re an established business or a budding startup, one thing for certain is, running a business isn’t always as straightforward as you might think. MaWhat’s the Difference Between a 1099 Contractor and a W2 Employee? By Adeptus Staff Understanding the distinction now can save you in the long run.

0 kommentar(er)

0 kommentar(er)